Among the various funding mechanisms in India, Syndicates represent an intriguing option—offering startups access to a group of investors led by a key figure, often referred to as the “Syndicate Lead”.

Syndicates are the one that stands out as a unique blend of flexibility, meanwhile getting doubted by the founders for some of its nuances. This blog is an attempt to bring clarity to founders so as to better understand such nuances and make more informed decisions while fund raising.

Unlike traditional angel networks or venture capital firms, syndicates occupy a unique space in the funding spectrum. They are neither as formalized as VCs nor as informal as angel groups.

In this article we will go deeper realistically to break down the Indian syndicate funding model from a startup's perspective, exploring its pros and cons, equip founders with the insights they need to decide whether syndicates align with their long-term goals.

| What is a Syndicate?

In Indian context, and for the purpose of this article, Angel Syndicates are vehicles which operate on SEBI CAT I- VCF - Angel Funds license and are regulated and managed professionally by experienced Investment professional(s).

In simple terms, a syndicate is a group of individual investors who pool their resources to invest in a startup. Typically, this group is led by a Syndicate Lead, an experienced investor or industry expert who identifies the opportunity, vets the business, and negotiates terms on behalf of the group. The lead essentially acts as a bridge between the startup and the collective of investors, simplifying the process for both sides.

| The History : Why Does This Structure Exist?

The First Step Towards the Startup Ecosystem

In the early 2000s, India witnessed its first wave of startup investments through angel investors. These early contributors, primarily high-net-worth individuals (HNIs) and successful entrepreneurs, invited startups to pitch and provided backing. However, the absence of organized networks or regulatory oversight meant that these investments were largely informal, relying heavily on personal trust.

The Emergence of Venture Capital

By the mid-2000s, the need for more structured early-stage funding options led to the emergence of organized angel networks. This marked a significant shift, as these networks offered startups not just capital, but also access to broader professional networks.

While individual angels and networks played a pivotal role in India's startup journey, the increasing complexity and scale of funding demanded a more structured and flexible system. Syndicate funding emerged to fill this gap, enabling collaborative investments with greater organization and efficiency.

The SEBI Intervention

Recognizing the need for a structured approach to angel funding, the Securities and Exchange Board of India (SEBI) introduced its first Venture Capital Fund Regulations in 1996. This was an early attempt to encourage professionalized startup funding.

In 2012, SEBI took a significant step forward by introducing the Alternative Investment Fund (AIF) Regulations. This landmark regulation provided a formalized structure for pooled investments, catering to various categories of funds, including venture capital funds, angel funds, and private equity funds.

AIFs were categorized into three types:

- Category I: Includes venture capital funds, social venture funds, angel funds, and others focused on startups and early-stage ventures.

- Category II: Comprises private equity funds and debt funds.

- Category III: Focuses on hedge funds and funds deploying complex strategies.

Angel funds, a subcategory of AIFs under Category I, gained legal legitimacy and regulatory clarity.

Venture capital funds were primarily designed for scaling businesses that had achieved product-market fit and demonstrated clear growth trajectories. These funds typically offered larger investments with a medium- to long-term horizon, often spanning 5 to 10 years. [However, the source of capital for such funds need to be frozen before the start of deployment which discourages many HNI investors as they are not able to validate the opportunities that the funds will pursue and invest in.]

In contrast, angel networks catered to startups at the ideation stage, providing smaller investments with higher risk tolerance. While flexible, angel funding often fell short when startups required larger investments or faced challenges managing multiple investors, leading to cap-table clutter and administrative inefficiencies.

The Syndicate Structure:

Addressing Evolving Needs

Despite the contributions of VC funds and angel networks, early-stage startups and investors in India continued to face unique challenges. Startups required medium ticket sizes—too small for large VC funds to consider—but needed a more formalized and organized framework than angel networks could provide.

To address these challenges,

SEBI introduced specific guidelines for angel funds later under the AIF regulations. These guidelines were tailored to the needs of early-stage startups and investors while creating a professional regulated structure for early stage investments.

Key changes included reducing the minimum ticket size for angel investors to ?25 lakh, enabling a larger pool of HNI investors to participate in cohesive fund structures while having clarity on the opportunities where their funds will be deployed. This broadened the capital pool available for startups by encouraging participation from HNIs and Family Office investors. By allowing pooled investments, angel funds simplified cap tables for startups by reducing the administrative burden of managing multiple individual investors.

So because of its structure Syndicate funding is particularly most useful for -

Startups at bridge round like pre-Series A stages—critical junctures where swift access to medium-sized checks can be a game-changer. These companies often find themselves in the "bridge round" phase, needing to build traction, extend runway and scale operations to position themselves for larger Series funding. At this stage, startups are typically focused on achieving milestones that will ensure a strong valuation during their next significant raise.

The speed and flexibility of syndicate funding allow startups to secure vital resources at mission-critical moments, avoiding delays that could derail momentum, and help them to cross the traction threshold necessary to enter the J-curve of rapid growth.

Many globally recognized companies, including Uber, Dropbox, and Reddit, have successfully leveraged angel syndicate funding at similar stages, underlining its impact on early-stage ventures.

Why These Changes Were Necessary :

SEBI’s guidelines for angel funds and syndicates brought a more flexible approach to early-stage funding, addressing limitations of the traditional VC fund framework established in the 1990s.

Syndicate model is a blending approach of Angel Networks and VC funds, while aligning with SEBI regulations for transparency and accountability.

Now, let's understand the Parties Involved in these funding structures and their respective roles -

1. Founders / Startup

The founders pitch their business idea to attract syndicate leads and investors. They are responsible for presenting a compelling story, clear financial projections, and a robust growth plan to build traction before substantial series rounds.

Their role involves preparing detailed documentation, handling investor queries, and managing relationships post-investment.

2. Syndicate Lead / Angel fund lead

The syndicate lead maintains contact with investors and acts as the anchor investor and champion of the startup within the syndicate. The syndicate lead optionally may ask founder(s) to pitch in front of the investors.

They are in charge of due diligence, negotiating terms, and leveraging their network to attract investors into the deal. Syndicate leads also play a vital role in ongoing support to the startup, serving as a liaison between founders and the investor group.

At Windrose Capital, we prioritize best practices by incorporating investor-founder interaction sessions as a standard process. These sessions enable founders and investors to align their visions, fostering mutual understanding while uncovering potential synergies that increase the odds of success for the startup.

3. Investors

In a syndicate structure, investors are typically individual investors or high-net-worth individuals (HNIs) who pool their capital into the syndicate.

Their primary role involves evaluating the startup for investment and providing funding, with minimal active participation in decision-making or day-to-day operations. Additionally, they may explore other synergies to foster business growth.

4. Trustee

Trustees act as custodians, ensuring the interests of all parties are safeguarded. Startups typically have no direct interaction with trustees.

Trustees ensure compliance and proper execution of the syndicate's financial, compliance, and legal responsibilities. They manage the funds, oversee disbursements, and ensure alignment with regulatory guidelines.

5. Fund Manager / Platform

Platforms like AngelList, Invstt, Let's Venture, etc are used by syndicate leads to channel capital to startups. Fund managers or platforms facilitate the overall process.

These platforms offer structured services to streamline fundraising, including legal documentation, fund pooling, and compliance management.

Let’s understand with a realistic example -

Let a startup called TechieShark looking to raise seed funding. Instead of approaching a single investor or a VC firm, TechSpark connects with a syndicate lead—a seasoned entrepreneur named Anil.

In this setup:

• Anil, the syndicate lead, acts as the main point of contact for TechieShark, handles negotiations, and represents the group of investors.

• The co-investors, while contributing smaller amounts, gain access to the deal without having to negotiate or evaluate the startup individually.

For TechieShark, the syndicate structure means dealing primarily with Anil instead of managing multiple investors, making the process more streamlined. However, this also means that Anil’s leadership and decision-making influence the dynamics of the investment.

This example highlights how syndicates function, offering a combination of pooled resources, simplified processes, and shared risk for both startups and investors. At the same time, startups need to be mindful of the collective nature of syndicates, which can bring varying expectations from multiple co-investors.

One of the big differentiation between Angel Funds and VC Funds lies in the timeline for capital deployment. Because once the required commitments from participating investors are secured, the funds are often wired to the startup's account in a matter of weeks.

For startups needing immediate capital to seize time-sensitive opportunities, this timeline can be a critical bottleneck.

This speed and efficiency make Angel Funds and syndicates particularly valuable for early-stage startups that prioritize quick access to resources over the promise of larger sums.

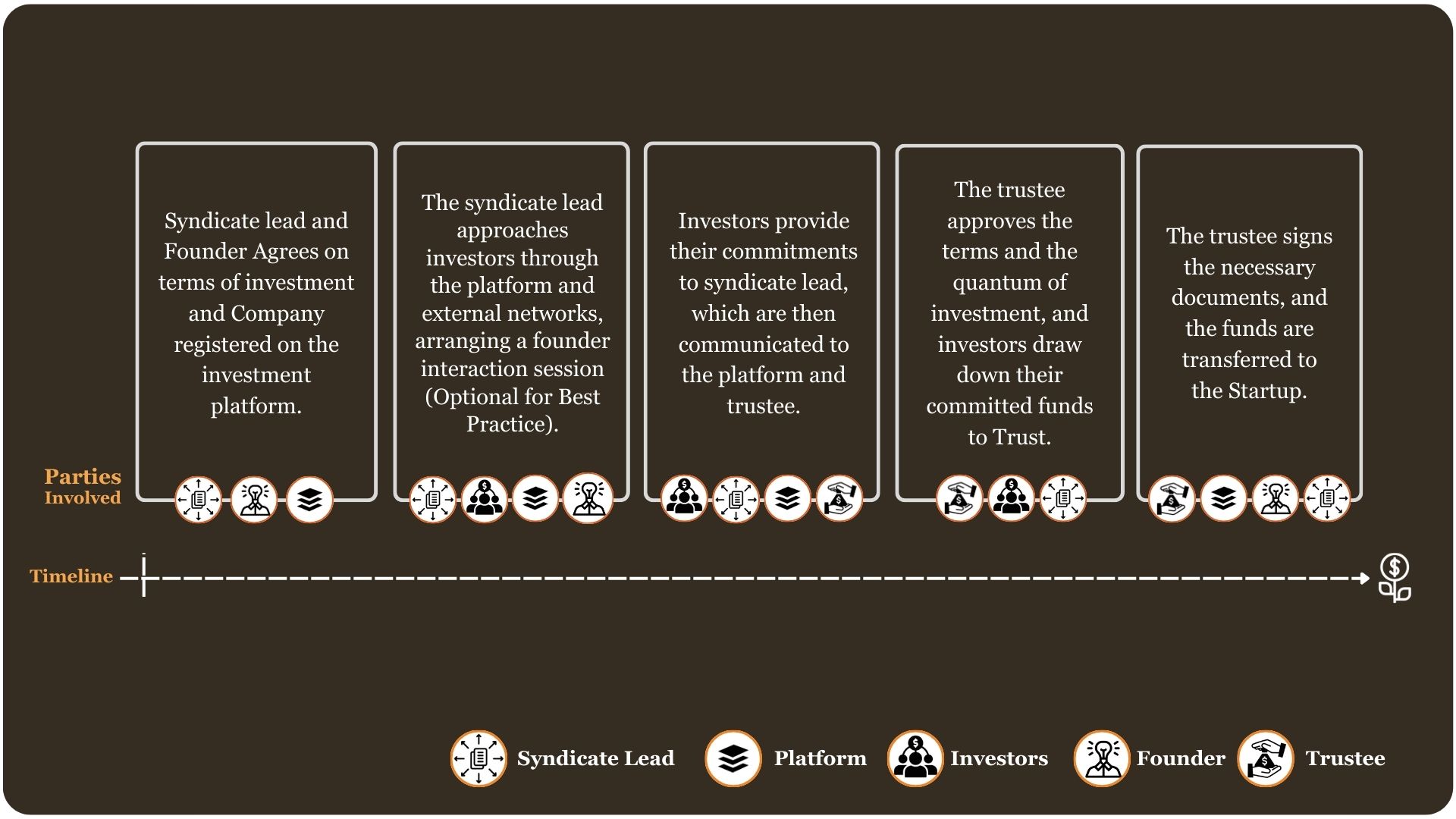

Let’s now explore the entire process and the key parties involved in raising funds through an Angel Fund or Syndicate Fund -

Syndicate funding operates as an objective focused and flexible investment mechanism where investors pool resources through a special purpose vehicle (SPV) to support startups.

The process begins with the syndicate lead and the startup agreeing on the terms of investment. Once finalized, the startup is registered on a dedicated investment platform that streamlines communication and documentation. Next, the syndicate lead taps into their network of investors using the platform and external channels.

To foster alignment between the founder and investors, some disciplined syndicate leads arrange the founder interaction sessions, offering investors a deeper insight into the startup's potential. Investors then commit funds, and these commitments are communicated to both the platform and the trustee. Simultaneously, the syndicate lead negotiates final terms with the startup to ensure mutual agreement.

Once investor commitments are secured, the trustee reviews and approves and ensures terms and the quantum of the investment. Investors are then required to draw down their committed funds, which the trustee oversees. After executing the necessary legal documentation, the funds are transferred to the startup, marking the culmination of the syndicate investment process.

This streamlined approach provides startups with timely access to capital while maintaining transparency and regulatory compliance.

| Pros and Cons of Syndicate Investment for a Startup

Pros

1. Faster Decision-Making

With fewer approval layers, syndicates typically make decisions quicker unlike traditional venture capital firms.

2. Flexible Investment Terms

Syndicates often offer more flexible and tailored terms compared to larger institutional investors like VC firms. This flexibility allows startups to negotiate on aspects like valuation, equity stakes, and post-investment involvement, making it easier to align terms with the company’s immediate and long-term needs.

3. Lower Investment Barriers

By pooling funds from multiple co-investors, syndicates reduce the barriers for individual investors, making it easier for startups to raise the desired amount of capital without relying on a single large investor.

4. Business’s Reputation

Syndicate funding not only enhances a business’s reputation by showcasing the collective confidence of seasoned investors but also positions the venture as a credible and investable entity in the market. Simultaneously, it enables founders to forge valuable relationships within an expansive network of investors, facilitating access to strategic insights, future funding opportunities, and industry influence.

5. Potential Strategic Partnerships

The investors in a syndicate are typically experienced entrepreneurs or HNIs who may provide more than just financial backing. They can open doors to new partnerships, customer bases, and markets, offering valuable support beyond just the money invested.

Cons

1. Capital Commitment uncertainty

In contrast, Angel Funds and syndicates operate with a more agile approach. While the lead investor or syndicate may not guarantee the same size of capital upfront as a VC fund, the process is remarkably faster.

2. Potentially Lower Value Addition Beyond Capital

While syndicates may offer valuable networks, they often fall short in terms of hands-on, post-investment involvement. Traditional VCs often have an established track record of mentoring and guiding startups, with dedicated resources for supporting portfolio companies.

Syndicate investors, on the other hand, may not always be as involved, especially if they are passive investors. While some syndicates, led by experienced individuals, might provide strategic advice and operational guidance but it’s totally up to their interest.

3. No follow-on visibility

One of the drawbacks can be that syndicate investors may not be as committed to future funding rounds as VCs, who often have a more interest in continuing to support their portfolio companies. If the startup requires additional funding down the line, there is no guarantee that the syndicate co-investors will continue their investment, forcing the startup to go back to the drawing board and potentially seek out new investors.

Raising capital from the syndicates is a compelling option for the early stage startups who need quick capital with minimal bureaucracy. For ventures with a clear vision but limited access to institutional investors, syndicates can provide the initial push to scale. However, this path comes with its own set of Prerequisites—demanding founders to be strategic, proactive, and prepared to manage a diverse group of investors.

With the right alignment of stage, needs, and expectations, syndicates can serve as a valuable milestone in a startup’s growth journey.